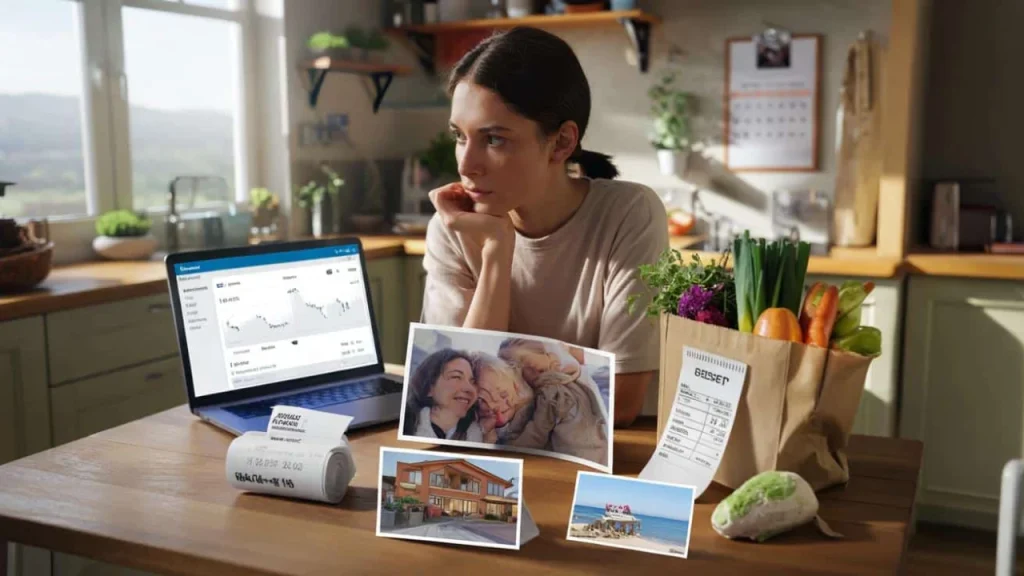

Sarah stared at her phone screen in the grocery store checkout line. The banking app showed $847.23 in her checking account. The number meant nothing to her—just digits floating in digital space. She bought the organic strawberries anyway.

Two hours later, scrolling through apartment listings, she saw a place for $1,200 a month. Suddenly, that same $847 transformed. It wasn’t just a number anymore. It was two-thirds of rent. It was three weeks of groceries. It was the reason she’d have to skip her sister’s birthday dinner next week.

Same amount of money. Completely different reality. That moment when abstract numbers become tangible pieces of your life? That’s where real financial awareness begins.

The brain science behind meaningful money

Our brains weren’t designed for digital banking and compound interest calculations. They evolved to understand “enough berries for winter” and “can I trade this for shelter.” When we see $2,400, our neural pathways struggle to process what that actually means for our daily lives.

- The 6 habits secretly sabotaging your happier life after 60 (most people never notice #4)

- This bathroom moisture hack is quietly saving homeowners from mold and expensive repairs

- This everyday activity quietly saves hand strength after 66 (most people ignore it completely)

- This bathroom trick makes dirty tile grout look brand new in 15 minutes without scraping it out

- This grey hair trend is making women look 10 years younger without a single drop of dye

- China’s empty metro stations in 2008 fooled everyone—here’s what we missed about their master plan

“The human brain processes concrete comparisons far better than abstract numbers,” explains Dr. Michael Rodriguez, a behavioral economist at Stanford University. “When someone says they have $5,000 in debt, it feels manageable. When they realize that’s five months of car payments, the urgency hits differently.”

This disconnect explains why so many people check their bank balance but still overspend. The numbers feel fake, like points in a video game. But the moment you translate $150 into “that’s my entire weekly food budget,” your spending behavior shifts immediately.

Financial awareness improves dramatically when we stop thinking in dollars and start thinking in life chunks. A recent study from the Federal Reserve found that people who regularly converted their expenses into “hours of work needed” or “days of expenses covered” made better financial decisions 73% of the time.

How to make your money feel real

The most effective way to build financial awareness is creating personal conversion charts that translate numbers into meaningful comparisons. Here are the frameworks that work best:

- Time-based thinking: “$200 = 8 hours of work after taxes”

- Experience swaps: “$500 = one weekend trip with friends”

- Security measures: “$1,000 = two weeks of emergency expenses”

- Goal progress: “$300 = 15% closer to that laptop I want”

| Dollar Amount | Abstract Feeling | Meaningful Translation |

|---|---|---|

| $50 | Not much money | Full tank of gas |

| $200 | Medium expense | One week of groceries |

| $800 | Big number | Two-thirds of monthly rent |

| $2,000 | Huge amount | Three months of emergency fund |

| $5,000 | Life-changing sum | Six months of basic expenses |

“I tell my clients to create their own personal price index,” says financial planner Jennifer Walsh. “Instead of thinking in dollars, think in ‘coffees’ or ‘rent portions’ or ‘vacation days.’ Money becomes real when it connects to something you actually care about.”

The key is choosing comparisons that matter to your specific life. If you don’t drive, don’t use gas tank analogies. If you never eat out, don’t measure in restaurant meals. Pick the expenses and goals that actually shape your daily decisions.

Why this changes everything about spending

When financial awareness kicks in through meaningful numbers, three major behavioral shifts happen immediately. First, impulse purchases become much harder to justify. Seeing that $80 sweater as “four hours of overtime work” or “two weeks of coffee money” creates natural pause points.

Second, budgeting stops feeling like restriction and starts feeling like planning. Instead of arbitrary spending limits, you’re allocating portions of your real life. “I can afford three nice dinners out this month” feels completely different from “I budgeted $150 for restaurants.”

Third, financial goals become emotionally compelling rather than mathematically abstract. Saving $10,000 feels impossible. Saving “enough money for six months of freedom if I lose my job” feels urgent and important.

Lisa Chen, a marketing manager in Seattle, discovered this accidentally when her budget app started showing expenses as “hours worked to afford this.” Her daily $6 coffee became “20 minutes of my morning commute.” Her streaming subscriptions became “two hours of work every month.”

“I didn’t cancel everything,” Chen explains. “But I started choosing consciously instead of just swiping my card. Some things were worth the trade-off. Others weren’t.”

This approach works because it taps into loss aversion—our natural tendency to feel losses more intensely than gains. When you frame spending as trading away pieces of your time, security, or future experiences, the psychological weight shifts entirely.

The ripple effects of financial clarity

Once numbers start feeling meaningful, financial awareness creates momentum in unexpected areas. People report feeling more confident in salary negotiations because they can clearly articulate what a raise means for their actual life quality.

Investment decisions become clearer too. Instead of wondering whether to put money in a retirement account, you’re choosing between “financial freedom at 60” versus “extra vacation money now.” Both are valid choices, but the trade-off becomes transparent.

Even major life decisions shift when you can translate them into meaningful terms. Should you buy a house? That depends on whether you value “building equity” more than “flexibility to move” and “extra money for experiences.”

“Financial literacy isn’t really about understanding compound interest formulas,” notes economist Dr. Amanda Foster. “It’s about understanding what money means in your specific life context. Once people make that connection, the technical stuff becomes much easier to learn.”

The transformation isn’t just individual. When couples start translating their financial decisions into shared meaningful terms, money conversations become less stressful and more productive. Instead of arguing about spending $200, they’re discussing whether they prefer “one nice dinner date” or “four casual lunch dates.”

FAQs

How do I start making my money feel more meaningful?

Begin by identifying your three biggest monthly expenses and three most important financial goals. Practice translating any spending decision into those terms.

What if I’m bad at mental math for these conversions?

Create a simple reference chart on your phone with common amounts translated into your personal meaningful terms. Update it monthly as your situation changes.

Does this method work for people with irregular income?

Yes, but focus on time-based comparisons rather than fixed expense ratios. Think “how many hours of work is this worth” instead of “what percentage of rent.”

Can this approach help with debt payoff?

Absolutely. Instead of seeing debt as a number, frame it as “months of freedom delayed” or “experiences I’m trading away.” This creates urgency without shame.

How often should I recalibrate these meaningful comparisons?

Review your personal conversion rates every few months or whenever your income or major expenses change significantly.

What if this makes me too anxious about spending?

Start with larger purchases only. Once you’re comfortable with conscious spending decisions, gradually apply the framework to smaller expenses.