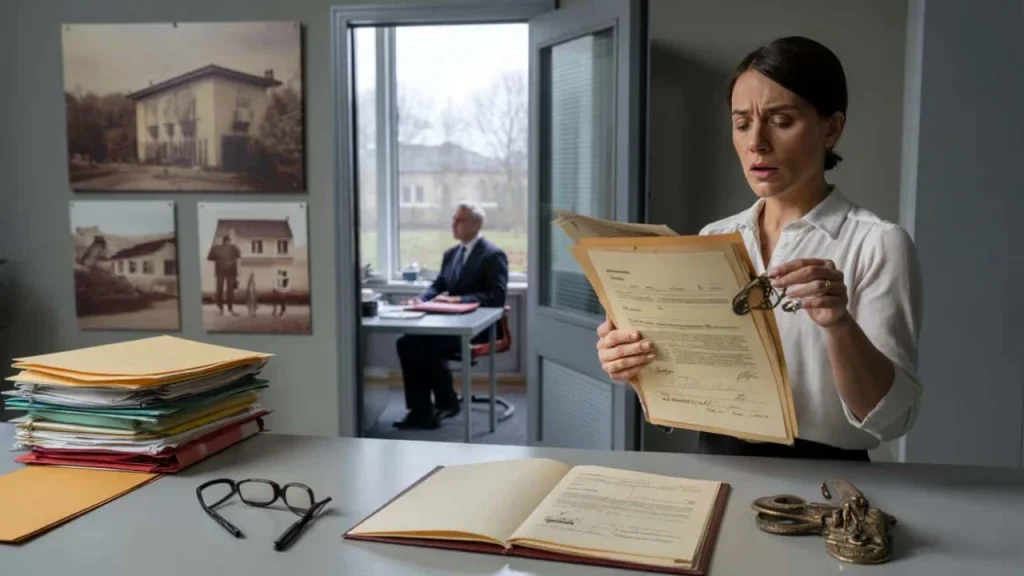

Sarah stared at the notary’s document, her hands trembling slightly. Just three weeks after her father’s funeral, she’d expected a straightforward meeting about splitting the family home with her sister. Instead, she discovered that under new rules, her distant uncle—whom she’d met twice in her life—would receive a larger tax-free portion than either daughter. The notary’s gentle explanation felt like a slap: “The February reform has shifted some priorities, I’m afraid.”

Walking to her car, Sarah felt something fundamental had broken. The assumption that children come first in their parents’ legacy suddenly seemed naive.

She wasn’t alone in this shock.

How the Inheritance February Reform Quietly Changed the Game

Across the nation, families are stumbling into the same cold reality. The inheritance February reform didn’t arrive with fanfare or front-page headlines. Instead, it slipped into law through technical amendments and bureaucratic language that few people understood until it was too late.

- This overlooked IRS rule could put $2,000 direct deposit in your account by February

- Daily showers for seniors over 65 can quietly become dangerous, doctors warn about new bathing frequency

- Flight attendants notice these 12 revealing things about you before you even find your seat

- China’s hyperloop technology hits 623 km/h in 2 seconds while Western projects still chase funding

- This everyday kitchen drawer item keeps bananas yellow and fresh for 14 days straight

- ATM card stuck? This hidden button saves your card in 30 seconds (but most people never find it)

The reform fundamentally reshapes who benefits most from family wealth transfers. While marketed as “modernizing inheritance law for contemporary families,” the changes create a system where direct descendants often face higher tax burdens and reduced automatic protections.

“We’re seeing a complete reversal of traditional inheritance priorities,” explains estate planning attorney Michael Chen. “Children who assumed they’d inherit their parents’ life work are discovering the law no longer automatically favors them.”

The timing makes it particularly cruel. Families learn about these changes during their most vulnerable moments—while grieving, sorting through belongings, and trying to honor their loved one’s memory.

What the New Rules Actually Mean for Families

The inheritance February reform introduces several key changes that directly impact how estates are distributed and taxed:

- Reduced automatic inheritance shares for children in favor of more “flexible” distribution options

- Lower tax thresholds for direct descendants while maintaining higher exemptions for certain distant relatives

- New incentives for charitable giving that can redirect substantial portions away from family members

- Expanded definitions of “family structures” that dilute children’s traditional priority status

- Complex trust mechanisms that favor sophisticated estate planning over simple family transfers

The numbers tell a stark story:

| Recipient Type | Old Tax Threshold | New Tax Threshold | Effective Change |

|---|---|---|---|

| Direct Children | $500,000 | $350,000 | -30% protection |

| Siblings/Cousins | $150,000 | $200,000 | +33% advantage |

| Charitable Organizations | No limit | No limit + incentives | Enhanced benefits |

| Distant Relatives | $75,000 | $125,000 | +67% increase |

“The math is brutal for children,” notes tax specialist Jennifer Walsh. “They’re getting squeezed from multiple directions while distant relatives enjoy better treatment than ever before.”

The Real-World Damage Is Already Starting

Beyond the numbers, the inheritance February reform is tearing apart family relationships and destroying decades of financial planning. The emotional toll goes far beyond money.

Consider Robert, a 45-year-old teacher whose mother spent years promising that her modest savings would help pay for his daughter’s college education. When she passed last month, Robert discovered that the new rules made it more tax-efficient to leave a substantial portion to his mother’s estranged nephew rather than her granddaughter.

“It feels like the government decided my mom’s love for her granddaughter matters less than some bureaucrat’s idea of fair distribution,” Robert says.

The reform particularly impacts middle-class families who lack sophisticated estate planning resources. Wealthy families can navigate the new rules with expensive legal help, while ordinary parents find their simple wills suddenly inadequate.

Estate planning professionals report a surge in panicked clients trying to restructure their inheritance plans. Many discover it’s too late—the reform’s retroactive elements affect estates already in process.

“We’re seeing families destroyed by rules they never knew existed,” warns probate attorney Lisa Martinez. “Adult children are learning that their parents’ modest homes and savings accounts are now subject to higher taxes than distant relatives would pay.”

The Hidden Agenda Behind the Changes

While officials claim the inheritance February reform promotes “equity” and “modern family structures,” critics argue it serves different purposes entirely. The changes generate substantial additional tax revenue while appearing to target only wealthy families.

The reform’s supporters argue it prevents “dynastic wealth concentration” and encourages charitable giving. However, the practical effect hits middle-class families hardest—exactly those with modest estates that would traditionally pass directly to children.

“This isn’t about breaking up billionaire fortunes,” explains policy analyst David Kumar. “It’s about extracting more taxes from regular families during their most emotionally vulnerable time.”

The timing wasn’t accidental either. February’s quiet implementation avoided the scrutiny that major inheritance changes typically receive. Most families only discover the new rules when it’s too late to adjust their planning.

What Families Can Do to Protect Themselves

Despite the challenging new landscape, families aren’t completely helpless. However, protection requires immediate action and often professional guidance.

Key strategies include:

- Immediate will review—existing documents may no longer achieve intended goals

- Trust restructuring—certain trust types can still prioritize children effectively

- Strategic gifting—transferring assets during lifetime may avoid new restrictions

- Tax planning coordination—timing estate settlements to minimize new penalties

- Family communication—ensuring everyone understands the changed landscape

The window for adjustments is narrowing rapidly. Families who act quickly may still preserve their intended legacy distribution, but delay could prove costly.

“Every month that passes makes it harder to work around these new rules,” warns estate attorney Chen. “The inheritance February reform was designed to be a trap for the unprepared.”

FAQs

When did the inheritance February reform take effect?

The reform officially began implementation in February 2024, with some provisions applying retroactively to estates already in probate.

Do these changes affect all inheritance situations?

Yes, the inheritance February reform applies to virtually all estates above minimal thresholds, regardless of family structure or estate size.

Can families challenge these new rules in court?

Legal challenges are possible but difficult, and courts have generally upheld the reform’s constitutionality while families bear the burden of compliance.

Are there any exemptions for families with special circumstances?

Very limited exemptions exist for certain disability-related situations, but most families must navigate the full impact of the new rules.

How much time do families have to adjust their estate plans?

There’s no official deadline, but the reform’s retroactive elements and ongoing implementation make immediate action crucial for maximum protection.

Will these changes be reversed by future legislation?

While possible, the inheritance February reform generates significant government revenue, making reversal politically unlikely in the near term.