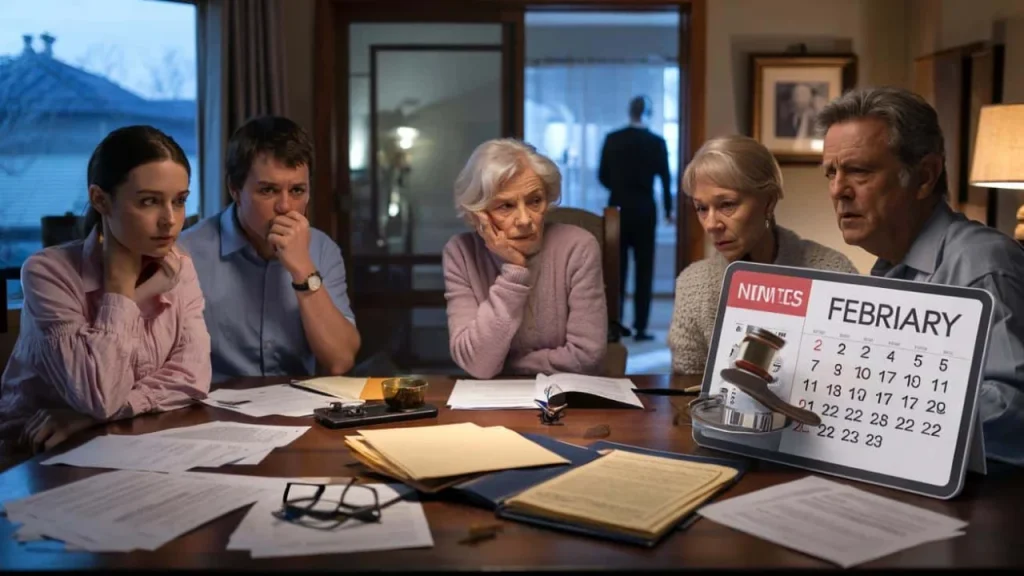

Sarah stares at the stack of papers covering her kitchen counter, her coffee growing cold. It’s been three weeks since her mother passed, and the family lawyer just dropped a bombshell: “You need to make these decisions by February, before the new inheritance law changes take effect.” Her sister calls from across the country, voice tight with stress. “What does this even mean for us?” Neither of them knows, but the clock is ticking.

The lawyer’s words echo in Sarah’s mind: “The rules you grew up understanding? They’re about to shift.”

This scene is playing out in living rooms across the country as families grapple with sweeping inheritance law changes that will reshape how estates are handled, taxed, and distributed. What seemed like distant legal reform has suddenly landed on kitchen tables and in family conversations, forcing difficult decisions at the worst possible time.

Everything You Thought You Knew About Inheritance Is Changing

For decades, inheritance law felt predictable. Kids got their share, spouses received protection, and families muddled through with basic understanding of “reserved heir” rights. You could postpone estate planning indefinitely, assuming the rules would stay the same.

- Your daily walking route is quietly rewiring your brain’s response to unexpected changes

- One tiny timing shift eliminated my $700 budget gap completely

- My plants were dying on cloudy days until I discovered wind steals water faster than blazing sun

- Peru’s 5,200 mysterious rock holes finally explained—and it wasn’t what archaeologists expected

- These 8 parenting habits secretly destroy your child’s respect—and most parents don’t even realize it

- House of the Dragon returns in two weeks and fans are already bracing for George R.R. Martin’s next heartbreak

Those assumptions are crumbling.

The new inheritance law changes arriving in February represent the most significant overhaul in a generation. They touch three critical areas that affect every family: who inherits what, how much tax gets paid, and how previous gifts are calculated into the final estate.

“We’re seeing families scramble to understand rules that seemed set in stone,” explains estate planning attorney Michael Chen. “The changes aren’t just technical adjustments—they fundamentally alter family wealth transfer strategies.”

Consider Tom, a 58-year-old father who’s been gradually transferring assets to his adult children through informal arrangements. Under the old system, many of these transfers flew under the radar. The new rules scrutinize lifetime gifts much more closely, potentially creating unexpected tax bills and inheritance complications.

His financial advisor delivered the wake-up call: “Everything you’ve done informally needs to be documented and reassessed under the new framework.”

What’s Actually Changing and Why It Matters

The inheritance law changes target specific areas that have created confusion and inequity for years. Here’s what families need to understand:

- Lifetime Gift Integration: Previous donations to family members will be calculated differently when determining final inheritance shares

- Blended Family Rules: New protections and restrictions affect how unmarried partners and stepchildren inherit

- Tax Bracket Adjustments: Modified exemptions and rates change the financial impact on heirs

- Documentation Requirements: Stricter record-keeping standards for all asset transfers

- Spouse Protection Enhancements: Surviving partners receive additional safeguards in certain situations

The most dramatic changes affect what lawyers call “recomposed families”—households where divorce, remarriage, or long-term partnerships create complex relationship webs.

| Family Type | Old Rules Impact | New Rules Impact |

|---|---|---|

| Traditional Nuclear | Minimal complications | Slight tax adjustments |

| Divorced with Children | Clear but limited options | More flexibility, stricter documentation |

| Unmarried Partners | Very limited protection | Enhanced rights with proper planning |

| Blended Families | Often problematic | Clearer guidelines, more complexity |

“The reform essentially forces families to be more intentional about their planning,” notes family law specialist Dr. Jennifer Walsh. “Informal arrangements that worked under old rules might create serious problems under the new framework.”

Real Families, Real Consequences

The inheritance law changes aren’t abstract policy shifts—they’re reshaping real family situations across the country.

Take Lisa, whose father has been gradually transferring shares of his small business to her over five years. Under previous rules, these transfers were relatively straightforward. The new legislation requires comprehensive documentation and may trigger different tax calculations when her father passes away.

Her accountant explained the stakes: “We need to reassess every transfer and potentially restructure the arrangement to avoid unexpected tax hits.”

Meanwhile, Robert faces a different challenge. His long-term partner of 15 years has no legal inheritance rights under current arrangements. The new rules offer pathways to protect her, but only if they act before February.

These stories multiply across demographics:

- Small business owners must reconsider succession planning strategies

- Divorced parents need to coordinate estate planning with custody arrangements

- Unmarried couples face new opportunities and deadlines for protection

- Blended families must navigate more complex but clearer guidelines

“Every family structure has different implications under these changes,” explains wealth management advisor David Park. “One size definitely doesn’t fit all anymore.”

The timing pressure adds another layer of stress. Families already dealing with illness, loss, or major life transitions must now accelerate estate planning decisions they might have postponed for years.

Perhaps most significantly, the inheritance law changes affect how families communicate about money and mortality. Conversations that were once postponed indefinitely now have urgent deadlines.

The February Deadline Reality

As February approaches, professional estate planners report unprecedented demand for consultations. Families who never considered formal estate planning are scheduling emergency meetings with lawyers and financial advisors.

The rush creates practical challenges. Qualified professionals are booking months in advance, and complex family situations require time to analyze and restructure properly.

“We’re seeing families try to compress years of planning into weeks,” observes estate attorney Maria Rodriguez. “It’s not ideal, but it’s the reality these changes have created.”

For families still in the early stages of understanding these changes, experts recommend focusing on immediate priorities: documenting existing arrangements, identifying potential problem areas, and seeking professional guidance as soon as possible.

The inheritance law changes represent more than technical adjustments—they’re forcing a national conversation about family wealth, fairness, and protection that many households have avoided for too long.

FAQs

Do these inheritance law changes affect everyone?

The changes impact all families, but the effects vary significantly based on your family structure, existing arrangements, and estate size.

What happens if I don’t make changes before February?

Your estate will be governed by the new rules, which might create different outcomes than you intended under the previous system.

Are these changes permanent?

Yes, this represents a fundamental shift in inheritance law that’s designed to be the new permanent framework.

Do I need a lawyer to navigate these changes?

While not legally required, the complexity of the new rules makes professional guidance highly recommended for most families.

What should be my first step?

Start by documenting your current arrangements and identifying your family structure’s specific challenges under the new rules.

Will these changes increase my tax burden?

The tax impact varies by situation—some families will pay more, others less, depending on their specific circumstances and planning strategies.