Maria switched on her electric kettle for morning coffee in her Prague apartment, unaware that the power flowing through her walls was about to become part of one of the biggest energy deals in European history. Across the continent, millions like her depend on a complex web of power plants, gas pipelines, and electricity networks that most people never think about.

But behind the scenes, corporate giants are reshaping who controls Europe’s energy future. And this week, a massive €5.1 billion deal just changed everything.

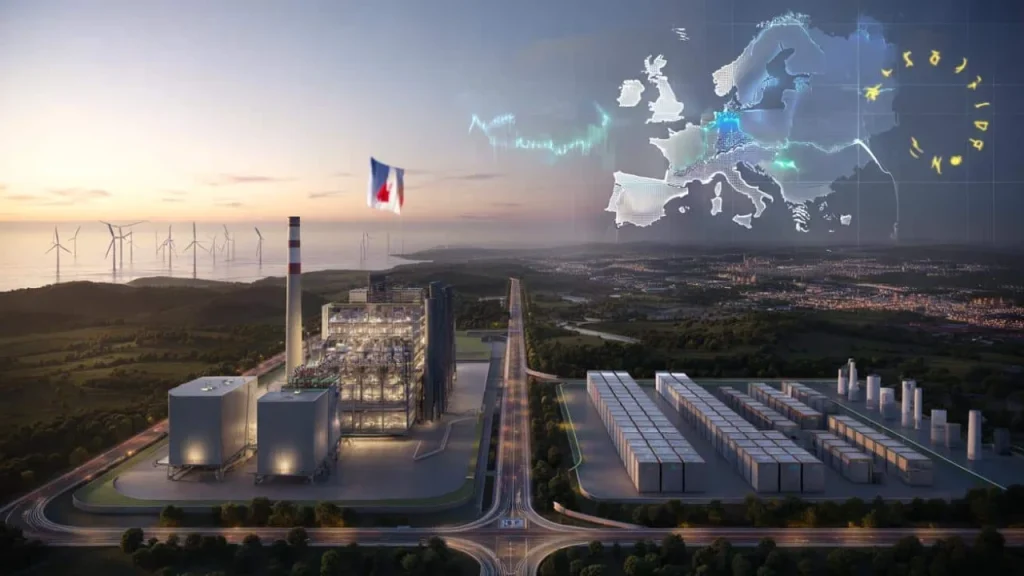

The TotalEnergies takeover of Czech energy powerhouse EPH isn’t just another corporate acquisition. It’s the birth of a European energy superpower that could determine how your electricity bills look for decades to come.

France Takes Control of Europe’s Power Grid

TotalEnergies has just pulled off one of the most strategic moves in European energy history. The French oil giant is buying a 50% stake in EPH’s flexible power platform for €5.1 billion, but here’s the twist – they’re paying entirely with their own shares, not cash.

- Why emotional habits control you before your brain even notices what’s happening

- I stopped comparing my finances to others and discovered something that changed everything

- Why the Cosori TwinFry is quietly replacing ovens in thousands of kitchens this month

- This one simple rule stops mess from quietly taking over your entire home

- Heat pumps hit homeowners with €20,000 bills—but what installers aren’t telling you changes everything

- Why Balance Exercises for Seniors Are More Crucial Than Most People Realize

This isn’t your typical buyout. TotalEnergies will issue about 95.4 million new shares at €53.94 each, making EPH one of their biggest shareholders with 4.1% of the company. It’s like a corporate marriage that binds both companies together for the long haul.

“This deal doesn’t just buy assets – it creates a strategic alliance that will dominate European energy for years to come,” explains energy analyst Dr. Klaus Weber. “TotalEnergies is essentially betting the farm on flexible power generation.”

The transaction puts EPH’s €10.6 billion worth of power plants, gas infrastructure, and energy storage under partial French control. Expected to close by mid-2026, this move comes at a critical time when Europe is scrambling to secure reliable energy while transitioning away from fossil fuels.

Meet EPH: The Shadow Giant You’ve Never Heard Of

While TotalEnergies makes headlines, EPH has been quietly building an energy empire since 2009. Founded by Czech and Slovak investment groups, this company made its fortune by buying the assets that nobody else wanted.

Coal plants facing closure? EPH bought them. Gas pipelines deemed unprofitable? EPH snapped them up. Thermal power stations that big utilities wanted to dump? EPH turned them into cash cows.

Their strategy was brilliantly simple: acquire cheap, restructure aggressively, and squeeze value from infrastructure that still keeps the lights on across Europe. While everyone else chased shiny new wind farms, EPH focused on the unglamorous but essential backbone of Europe’s energy system.

| Year | Major EPH Acquisition | Value |

| 2013 | Slovak Gas (including SPP stake) | €2.6 billion |

| 2014-2016 | Thermal assets from EDF, E.ON, RWE | Multiple deals |

| 2019 | French generation assets from Uniper | Undisclosed |

| 2024 | 50% partnership with TotalEnergies | €5.1 billion |

Today, EPH controls power plants across Germany, France, Slovakia, and the Czech Republic. They hold a 49% stake in Eustream, Slovakia’s gas transmission operator that moves Russian gas across Europe. Not bad for a company most people have never heard of.

“EPH understood something that traditional utilities missed,” notes energy consultant Sarah Mitchell. “In a world of intermittent renewables, flexible power generation becomes incredibly valuable. They positioned themselves perfectly for this moment.”

What This Mega-Deal Means for Your Energy Bills

Here’s why the TotalEnergies takeover should matter to every European household. This new energy giant will control a massive portfolio of flexible power assets – exactly the kind of infrastructure needed to balance the grid when the wind isn’t blowing and the sun isn’t shining.

The combined entity will have unprecedented influence over electricity prices across multiple European markets. When renewable energy output drops and demand spikes, these flexible gas plants and storage facilities can ramp up quickly – but at a premium price.

Key areas where you’ll feel the impact:

- Electricity pricing: Greater market concentration could mean less competition and higher bills during peak demand periods

- Grid stability: More coordinated flexible capacity should improve supply security and reduce blackout risks

- Energy transition: Combined resources will accelerate battery storage deployment and renewable integration

- Gas supply: Enhanced control over gas infrastructure could improve energy security amid geopolitical tensions

The timing couldn’t be more critical. Europe is racing to reduce dependence on Russian energy while maintaining grid stability during the renewable energy transition. This TotalEnergies takeover creates a formidable player with the scale and flexibility to navigate these challenges.

“We’re witnessing the creation of a European energy champion that can compete globally while serving local markets,” explains Dr. Andreas Müller, professor of energy economics at Vienna University. “But consumers should watch carefully how this market power gets used.”

The New Energy Landscape Taking Shape

This deal signals a fundamental shift in how Europe’s energy sector is organizing itself. Instead of separate oil companies, utilities, and infrastructure operators, we’re seeing integrated energy giants that control everything from gas production to electricity generation to battery storage.

TotalEnergies isn’t just buying assets – they’re acquiring strategic positioning for the next phase of Europe’s energy evolution. The company gains immediate access to 15 gigawatts of flexible power generation capacity and a partner with deep knowledge of Central European energy markets.

For EPH, the partnership provides access to TotalEnergies’ global reach, financial resources, and renewable energy expertise. It’s a marriage of EPH’s operational excellence with TotalEnergies’ strategic vision and capital strength.

The regulatory approval process will be intense. European authorities will scrutinize whether this concentration of energy assets serves consumer interests or creates dangerous market dominance. Employee consultations across multiple countries will determine if jobs are protected during the integration process.

“This is more than a business deal – it’s about who controls Europe’s energy future,” warns consumer advocate Elena Rodriguez. “Regulators need to ensure this doesn’t come at the expense of competition and affordability.”

FAQs

What exactly is TotalEnergies buying from EPH?

TotalEnergies is acquiring a 50% stake in EPH’s flexible power platform, which includes gas-fired power plants, cogeneration facilities, and energy storage assets across Europe, valued at approximately €10.6 billion.

Why is TotalEnergies paying with shares instead of cash?

The share-based payment creates a long-term strategic partnership rather than a simple acquisition, making EPH a major TotalEnergies shareholder with 4.1% ownership and aligning both companies’ interests.

When will this deal be completed?

The transaction is expected to close by mid-2026, subject to regulatory approvals and employee consultations across multiple European countries.

How will this affect European electricity prices?

The combined entity will have significant influence over flexible power generation, which could impact pricing during peak demand periods when renewable energy output is low.

What makes EPH’s assets so valuable right now?

EPH controls flexible power generation that can quickly ramp up when renewable sources aren’t producing, making these assets crucial for grid stability during Europe’s energy transition.

Will this deal face regulatory challenges?

Yes, European regulators will carefully examine whether this concentration of energy assets serves consumer interests or creates concerning market dominance in electricity and gas markets.